China’s Electric Dream (Part 2) - Putting the Brakes On

The industry shakeout is already happening.

China’s EV market continues to experience accelerating growth, no doubt.

Banks have sized the total market in China at approximately USD 360 billion, and it is the fastest growing market globally at 118% year on year. Today, China contributes to over 56% of all global EV sales, and was responsible for 2.4 million EVs in the first half of 2022. This was equivalent to 26% of total car sales across China, up from 10% recorded in the first half of 2021. Notably, this was despite the sharp uptick of COVID restrictions in 2022 in key Chinese cities and the dimming economic sentiment.

However, the circumstances on the ground faced by individual companies paint a vastly different story. Beneath the glossy sheen reveals what a WeChat article author has called ‘the EV Hunger Games’. The shakeout of the market is already happening.

The Hunger Games

Drawn by the burgeoning market, companies have rushed into the fray in droves. The EV leaders (BYD, Nio, Li Auto, Xpeng) continue to lead the pack, joined by a flurry of younger pureplay EV upstarts all angling for a slice of the pie – think Aiways, LeapMotor, Hozon, BeyonCa. That’s not all. Traditional automakers like Geely, SAIC and Chery are also pivoting into the EV space, albeit some at a more cautious pace – after all, their ICE vehicle businesses continue to contribute the bulk of their revenues. Consumer tech companies like Xiaomi and Huawei are betting that the car will be the next major consumer platform and have publicly announced plans to move into EV manufacturing. Their existing infrastructure, capabilities and mobile phone ecosystems will put them on the advantage to make this pivot. Not to be left out, internet majors are pumping in capital to hedge their bets, though with a stronger focus on intelligent, digital connected cars – Alibaba has backed Xpeng, while partnering SAIC for a JV (IM Motor) for intelligent EVs; similarly Tencent has backed Nio and Aiways, while forming JVs with the likes of Changan Auto and Evergrande for smart EVs. A rough count has revealed that there are over 500 EV companies registered in China right now.

Needless to say, the market has been flooded. Market saturation is imminent. Investors I have spoken to have concurred, noting that the market is reaching a bottleneck. The industry has evolved from one that saw demand far outpace supply in 2021, to one that is seeing a pseudo price war in 2022 with widespread manufacturing overcapacity.

On the whole, EV companies are seeing disappointing sales numbers. Not only are EV sales falling slightly (though the percentage of EVs of total car sales continues to increase) in light of dimming consumer sentiment, previous market leaders like Wuling, Nio, Xpeng and Li Auto are losing market share (see Fig 1). Instead, BYD has strengthened its market leadership, followed by traditional ICE OEMs Geely, Chery and GAC Group, who have broken into the top 6.

This has ignited a price war, as automakers scramble to capture market share. Their struggles were thrown into stark relief when Tesla closed its flagship showroom in Beijing in October 2022 in view of slowing sales growth and customer footfall, and simultaneously slashed prices for its Model 3 and Model Y cars by as much as 9%. Similarly, Xpeng unexpectedly kicked off promotions in July this year, offering discounts of up to RMB 15,000.

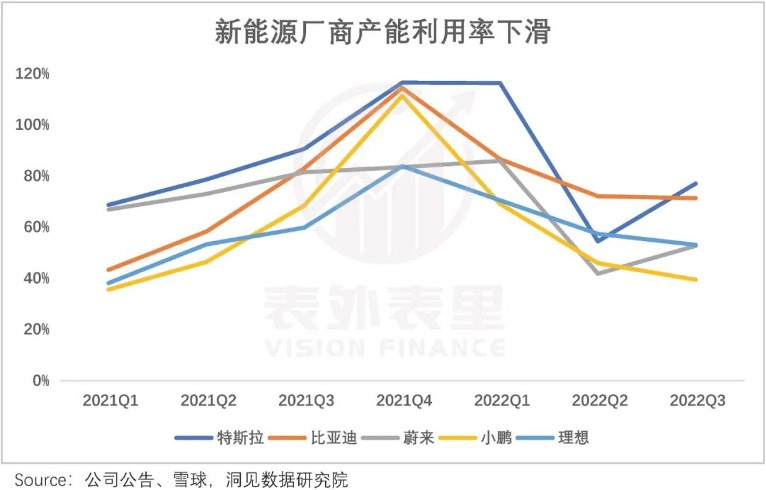

Underwhelming sales have revealed another problem on the supply side – manufacturing overcapacity. In the industry boom, companies rushed to invest in manufacturing facilities, motivated by the promise of burgeoning demand. In fact, the severe 供不应求 phenomenon seen in early days (watching existing players struggle to meet their overwhelming order volumes) likely spurred new entrants to err on the side of over-investing, in anticipation of the same demand. This has led to a drastic scale up in capacity from 2021 to 2022 (see Fig 2) that has been accompanied by declining sales. The result: lots of idle capacity in the market (see Fig 3) – and this is just for the top few EV brands; Tesla and BYD are at ~70% utilization, Nio and Li Auto at ~50%, and Xpeng’s is just under 40%. Should all facilities under construction come online, it is expected that overall factory utilization across the country will dip below 50%. Annual production capacity will exceed 15 million, but for an expected annual national sales figure of 7 million. The government has started to implement safeguards accordingly – provinces are not permitted to approve new projects until surplus capacity comes online, while new OEMs have found it increasingly difficult to obtain manufacturing licenses.

In a bid to maximize the investments sunk into the manufacturing facilities, companies are trying ways and means to drive sales. Some have chosen to enter new market segments/price tiers – Leapmotor announced intentions to enter the mid to high end market (its cars are presently in the low end, low margin segment) by launching 7 new models in the next 3 years. This price range accounts for the bulk of EV sales in China but at the same time, is the most competitive segment. Some, like Aiways, have chosen to avoid the impending bloodbath in China and target overseas markets where competition is less intense. That said, both are capital and resource intensive endeavours. Others will choose to engage in the price war in a bid to survive in their home market, kickstarting a fruitless race to the bottom.

Their troubles on the domestic front have been exacerbated by two external factors.

Firstly, the pull back of EV subsidies. The Chinese government had extended the provision of EV subsidies to 31 December 2023 (originally set to expire in December 2022) in a bid to stimulate consumer adoption following extensive COVID disruptions this year. That said, there is widespread acknowledgement in the industry that the government will eventually pull back, and with that, drive costs of owning an EV up.

Secondly, raw material costs have more than doubled this year amidst the pandemic, impacting EV makers around the world. Costs are spiralling, not simply those of critical battery minerals – lithium, cobalt and nickel –, but also the cost of steel and aluminum. AlixPartners has predicted that, in order to ride this out, automakers will have to moderate market expansion and refocus on profitability.

The Music Stops Playing

Rightfully so, investors are throwing caution to the wind and pulling back. The public markets have also responded accordingly, with most of the Chinese EV stocks slumping in recent months. Leapmotor’s recent IPO was accompanied by plunging share prices, heralding little optimism for other prospective EV listings.

Companies are starting to visibly struggle, with the combination of factors across falling sales, macro factors and overcapacity, compounded by funding drying up. WM Motors has been the latest, most public casualty – just a few weeks ago, CEO Freeman Shen announced substantial spending and salary cuts. It had built an annual production capacity of 250,000 but sold just 44,000 cars last year, a mere fraction compared to BYD’s 730,000 and Nio’s 100,000. In fact, a report revealed that the company was losing RMB 160,000 for every car it sold.

To overcome this, companies are continuing their efforts to boost sales. Hozon Auto has turned to supplying fleet operators and local governments in order to drive production and manufacturing utilization. Other companies have shared ambitious plans to internationalize, betting on the blue ocean that is ex-China markets, but have hit roadblocks trying to raise financing.

Many other automakers will seek to differentiate themselves with software offerings. Naturally, Xiaomi and Huawei’s key value propositions would be the integration with their mobile ecosystems, while Nio and Geely have also embarked on their own forays into the mobile phone business, which they predict would be natural complements to their cars. Many of the leading EV companies – Nio, XPeng – boast of ADAS features. Nio has launched its Autonomous Driving as a Service feature, which allows it to monetize via a separate subscription model based on the suite of ADAS features available. New entrant BeyondCa has chosen to position itself instead as a premium car brand with health monitoring features and bet on the growth of the premium car segment.

Placing Bets

As the market shakes out, it remains to be seen who will weather the storm.

Naturally, we should keep our focus on the market leaders – those who sustain strong sales figures and good manufacturing utilization, which speak to continued market traction, product quality and consumer confidence. Beyond the usual names like BYD and Nio who have demonstrated strong sales both in and out of China, it would be worthwhile to also consider brands who are global from Day 1. They have little or negligible market share in China but achieved good traction overseas. For example, Aiways, though not really a household name in China, has made itself a name in Europe since it entered in 2020, outpacing even Nio and Xpeng, and recently secured an order for 150,000 cars in Thailand. As it continues to grow, it would be worthwhile to keep our eye on them.

Another useful proxy would be the ability of these OEMs to integrate vertically across the supply chain – this would also speak to their financial positions and ability to take a more strategic long-term view to build up their competitive moats. Unlike Tesla, BYD not only produces its own batteries and cars, but has also announced intentions to acquire 6 lithium mines, which would guarantee enough supply for the next decade as well as some immunity to rising raw material costs. Likewise, Nio is moving upstream (into batteries, AV chips) and downstream (into mobile phones) – Founder & CEO William Li emphasized this during a recent internal speech, where he noted these efforts as critical to ensuring their survival, profitability and continued success.

Apart from the pureplay EV companies, one should not forget about the traditional ICE players who are pivoting into the EV space. Granted, they could be slower to move, but their experience, networks and existing capabilities in the automotive space should not be overlooked. As funding continues to dry up for new EV entrants, EV brands of legacy automakers like GAC’s Aion and Dongfeng’s Voyah have still managed to secure billions in funding. Judging from the market share distribution (Fig 1 above), these traditional OEMs should not be easily dismissed.

Another dimension to consider would be China’s evolving role in the global automotive supply chain. The core components of traditional ICE cars are the engine, the transmission, and the chassis – the US, Japan and Germany have long been global leaders in this space. With the advent of the (automotive) electric age, China is now given the chance to rewrite the narrative, with them comfortably in the driver’s seat. In other words, 换道超车. Core components of EVs are the battery, motor and electric control systems – 三电: 电池、电机、电控. Not just batteries and EVs, but with China’s EV dominance, Chinese EV component suppliers, both hardware and software, also have the potential to become best-in-class and globally competitive.

I think that could be the next wave to watch.